LInvesting in Creston: Community Financial Services BLOOM over time

By Alex Valentine

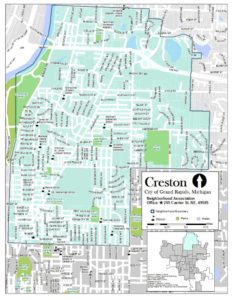

In 1996, the Plainfield branch of the Old Kent bank closed, leaving the Creston community with only one full-service banking option, NBD Bank (now Bank One). Soon after, the Creston Neighborhood Association (CNA) got word that NBD Bank would too close its doors at the beginning of 1998. Upon hearing the news, CNA rallied neighbors and won a six-month delay of the branch closing. Although the bank stayed open, NBD closed their lobby, which meant that bank users could be found bracing the elements in long lines that wrapped around the building.

Creston neighbors, working alongside CNA, decided to work towards opening a credit union in Creston to fill the gap left by local bank closures. In 1999, a core group of neighbors developed two strategies to make this goal a reality: 1) getting federal approval to open a new credit union and 2) persuading an existing credit union to open a new branch in Creston. Finally, with the generosity of the Dyer-Ives Foundation, CNA was given a $22,800 grant to start work on the Community Development Credit Union (CDCU), which would be a non-profit governed by members of CNA and the neighbors of Creston.

Multi-Products Credit Union (MPCU) (later known as My Personal Credit Union), partnered with CNA to develop the new credit union. MPCU and CNA worked tirelessly to bring back full banking services to the neighborhood, eventually purchasing the old Bank One building at 1327 Plainfield.

The Creston branch of MPCU opened its doors on February 1st, 2001. This not-for-profit cooperative provides full banking services, including savings and checking accounts, loan applications, and investing. At its opening, all members of the Creston Neighborhood Association had automatic membership to MPCU, and those who were not members of CNA could join for just $10. MPCU has since been rebranded, and is now called Bloom Credit Union. Bloom continues to meet crucial needs in the community.

A special thank you to CNA and the leadership of Jeff Bartlett, Bob Blackall, Dennis Childress, Rev. Neil Davis, Joye Endres, Bill Murphy, Joe Barnosky, Larry Capps, Jim Cronan, Glenn Disosway, Roberta Hefferan, Kerry Sims, and Paul Haan, the former executive director of CNA, all of whom worked on saving full banking services in Creston.

The Creston branch of MPCU opened its doors on February 1st, 2001. This not-for-profit cooperative provides full banking services, including savings and checking accounts, loan applications, and investing. At its opening, all members of the Creston Neighborhood Association had automatic membership to MPCU, and those who were not members of CNA could join for just $10. MPCU has since been rebranded, and is now called Bloom Credit Union. Bloom continues to meet crucial needs in the community.

A special thank you to CNA and the leadership of Jeff Bartlett, Bob Blackall, Dennis Childress, Rev. Neil Davis, Joye Endres, Bill Murphy, Joe Barnosky, Larry Capps, Jim Cronan, Glenn Disosway, Roberta Hefferan, Kerry Sims, and Paul Haan, the former executive director of CNA, all of whom worked on saving full banking services in Creston.

This article is part of a history series, created in commemoration of the Creston Neighborhood Association’s 40th anniversary, in partnership with Michigan Humanities and the Calvin University History Department.